dui auto prices car

dui auto prices car

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/HowToChooseYourCarInsuranceDeductibleSept.202021-e95559dfe0df4d0fb74b77b657c0bd52.jpg) insurance cheaper cheap insurance auto insurance

insurance cheaper cheap insurance auto insurance

What does an automobile insurance coverage deductible mean? If you backed your vehicle into a telephone pole, your accident insurance coverage would pay for the cost of the damages.

If the complete cost of repairs pertains to $1800, your insurance will just spend for $1300 (auto). You can discover your deductible quantities is noted on your declarations web page. Having to pay a deductible ways you can do a kind of cost-benefit evaluation before you make a claim with your insurance company.

What kind of insurance coverage calls for a deductible?, which covers the costs if you harm someone's residential or commercial Discover more here property or hurt somebody with your auto, never needs a deductible., and where you establish your deductible will certainly have an affect on your month-to-month insurance policy premium.

The Buzz on Car Insurance Deductibles: How Do They Work? - The Motley ...

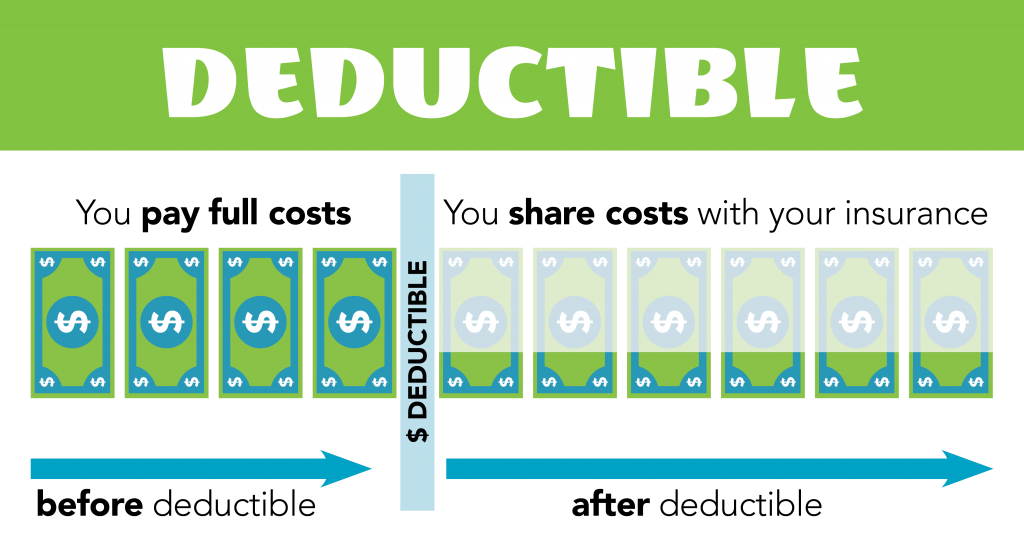

The opposite is likewise real, picking a reduced insurance deductible ways you'll need to pay a higher premium. You might be attracted to select a high insurance deductible to get a lower insurance policy costs, however bear in mind, there's an extremely real possibility you'll need to pay that deductible one day (insurance company). When selecting an insurance deductible, make certain it's a quantity you 'd actually carry hand if you needed to pay it (car insurance).

cheap car insurance auto insurance affordable cheapest car

cheap car insurance auto insurance affordable cheapest car

If you're an existing customer, call us to obtain registered. If you're new here, get a car quote online in under 5 minutes. credit score.

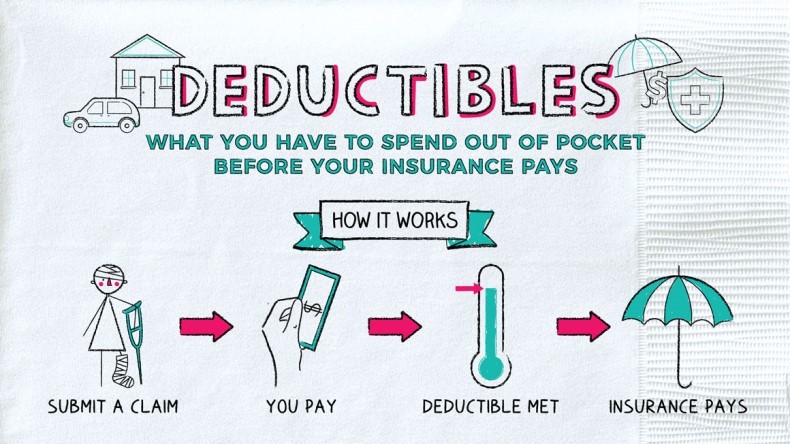

An insurance deductible is what you pay out of pocket to fix your cars and truck prior to your cars and truck insurance coverage pays for the remainder. If you carry thorough as well as crash protection on your car insurance, you will see an insurance deductible listed on your policy as a buck quantity.

When do you pay your deductible? You only pay the deductible for repairs made to your very own vehicle. Nonetheless, you do not pay an insurance deductible for other automobiles associated with the accident, even if you are located to blame. There are some exemptions to paying an insurance deductible for damage to your automobile.

How Comprehensive Deductible: How To Make The Smart Choice. can Save You Time, Stress, and Money.

This is where the value of your auto can be a large factor (insured car). For that factor alone, you might see a large cost dive in your costs if you go with the lower insurance deductible.

But if you're still leaning toward a higher deductible, assume about this: For how long would it take to recover what you'll spend on premium costs? If it's simply mosting likely to take you a year or two, the higher insurance deductible may still be looking excellent. Otherwise, the reduced insurance deductible might make even more sense (cheapest car insurance).

Think concerning just how you utilize your auto. If you live in a quiet neighborhood with a short commute to work, you might be comfy with a higher deductible. Be certain and also talk to your ERIE representative to help you determine which strategy is best for you.

Auto, home, and tenants insurance coverage policies use a deductible quantity to each and every case you make in a given year. Expect your home insurance policy has a $1,000 deductible.

The Best Strategy To Use For What Is A Deductible? - Insurance Dictionary

Relying on your policy, you may still be accountable for any type of associated copayment, the collection quantity you consent to pay for solutions like an examination or lab work. insurance. There are several various types of car protection available, yet you are most likely to encounter a car insurance coverage deductible with: Comprehensive insurance coverage (car insured).

This relates to damage to your vehicle from hitting something such as an energy pole or another car. insurers. In case of an accident, the crash insurance deductible only will put on repairing or changing your car. Any damage to another person's residential property that you're delegated would be covered under your obligation insurance instead, and liability insurance policy doesn't carry a deductible - credit score.

Recognized as "no-fault" insurance policy, PIP pays clinical expenses for both the insurance holder and anybody else in the vehicle at the time of an accident. This kicks in if you're in a crash triggered by a driver that doesn't have enough insurance to cover your injury and/or automobile damage or who doesn't have any insurance coverage at all.

insurance companies insurance cheap low cost auto

insurance companies insurance cheap low cost auto

Any kind of case you apply for damage that is covered by collision will certainly go through an accident insurance deductible. 1 The higher a deductible, the reduced the annual, semiannual or month-to-month insurance policy costs might be due to the fact that the customer is thinking a portion of the overall expense of a case. Maintain in mind that the insurance deductible quantity will certainly come out of the policyholder's pocket in the occasion of an at-fault automobile accident, which might eclipse the premium financial savings (insure).

Our What Is A Car Insurance Deductible? – Forbes Advisor Ideas

car insurance affordable auto insurance low-cost auto insurance insurance

car insurance affordable auto insurance low-cost auto insurance insurance

If the policyholder does not have an at-fault crash resulting in a claim, the person has paid even more for auto insurance than somebody with a greater deductible. suvs. When do you pay the insurance deductible for automobile insurance coverage?

This is just the situation as long as the expenses fall within the array of the coverage you acquired. Finally, a lessening deductible may ultimately result in a reduced insurance deductible or perhaps none whatsoever. This kind of insurance deductible benefits vehicle drivers for preventing mishaps by decreasing their insurance deductible each year they stay accident-free.

A high deductible will certainly reduce your total insurance rate, nevertheless it will increase your out-of-pocket costs if you submit an insurance claim. 1 Five concerns to aid you pick the ideal cars and truck insurance policy deductible In establishing the ideal deductibles, below are five concerns to consider before deciding: Just how do various insurance deductible degrees affect the insurance premium? This is an excellent inquiry as no 2 insurance policy companies will have the same deductible-premium ratio, and also states differ on their regulatory technique to the topic (dui).

That $800 currently comes out of the owner's wallet. If the owner had a $100 deductible, the out-of-pocket expenditure would certainly be just $100, giving a cost savings of $700. Is it much better monetarily to have a reduced insurance deductible and also a greater premium? That depends. Somebody with a low deductible/higher premium proportion can undergo a 10-year duration without filing an insurance coverage case.