cars cheaper car suvs car insured

cars cheaper car suvs car insured

Your insurer is lawfully called for to alert you prior to terminating your plan for nonpayment, but depending upon your insurance firm, you may have the ability to renew, or bring back, your canceled policy (vehicle insurance).

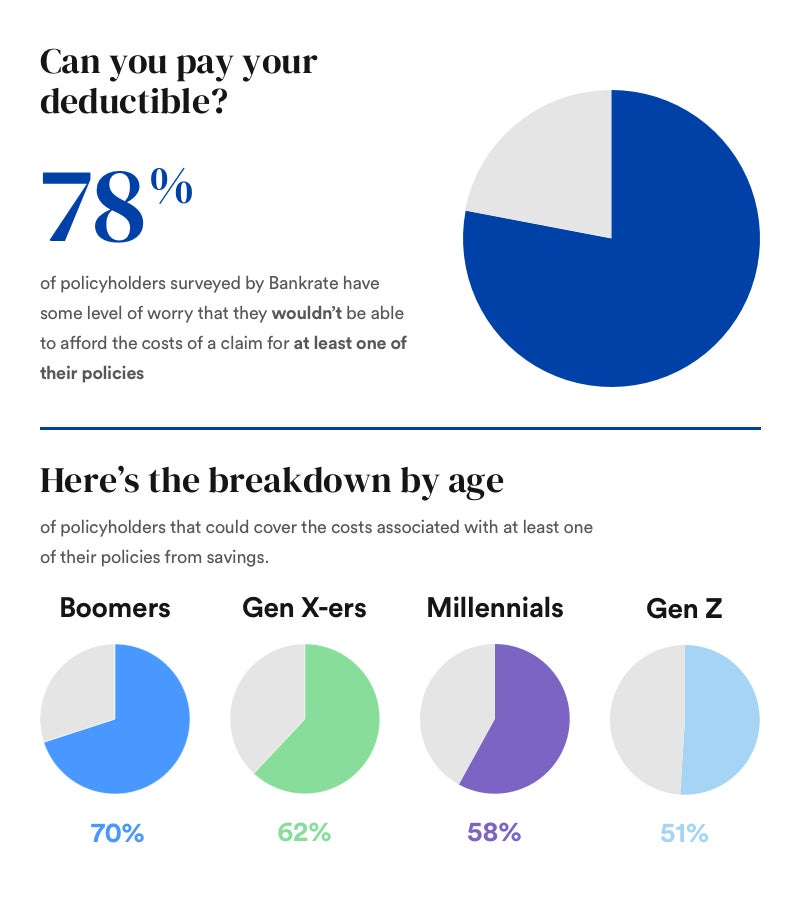

If your cars and truck is damaged in a crash, your insurance deductible enters play before suing. Your deductible is the quantity you are accountable for paying of pocket towards the problems prior to your insurance takes over the continuing to be equilibrium. car insurance. If your deductible is greater than the general repair work costs, your insurance provider will certainly not cover the damages.

Crash insurance coverage covers any damages to your car due to impact with another automobile. automobile. Collision insurance coverage is relatively costly, so the majority of people decide to conserve cash on premiums. It's advised that you talk with your insurance representative, as they can help you locate a policy that aligns with your state's prices.

It's suggested that you speak with your insurance firm, as they might be able to waive your insurance deductible. If you wait to sue, it's advised that you send it immediately so that your insurance firm can compensate you. If you choose a layaway plan, you might pay even more money with time however avoid paying a large round figure settlement.

Consult With Little & Sons Insurance Solutions Don't panic if you are incapable to cover your deductible. You should be able to solve this with your insurance firm (cheap car insurance).

Car Insurance: What You Need To Know - ÉDucaloi - The Facts

If somebody hit my vehicle, I probably would not also understand what occurred. You return to your vehicle after it's been parked for a while and also find a scrape down the side or a dent in the door that had not been there before.

If you're lucky, the individual liable left a note. An insurance deductible would apply. Bear in mind that accident coverage is optional if you picked not to acquire it, you would certainly have to pay for repair work out of pocket.

car insured perks auto car insured

car insured perks auto car insured

Often insurance companies have the ability to locate the liable party and also recuperate some or every one of the fixing costs. In a best-case scenario like this, the insurance provider might refund your collision deductible in whole or partly depending upon your policy arrangements.

Cars and truck proprietors frequently presume that if their vehicle is totaled, it will be replaced at the quantity they paid, or at the very least the quantity they owe. This is not so. That is why lots of auto insurer offer space insurance coverage (or loan/lease payoff insurance policy) as an optional coverage. You must additionally Helpful hints have thorough and also accident coverage to buy void coverage, yet if you rent or finance your car, those are generally needed.

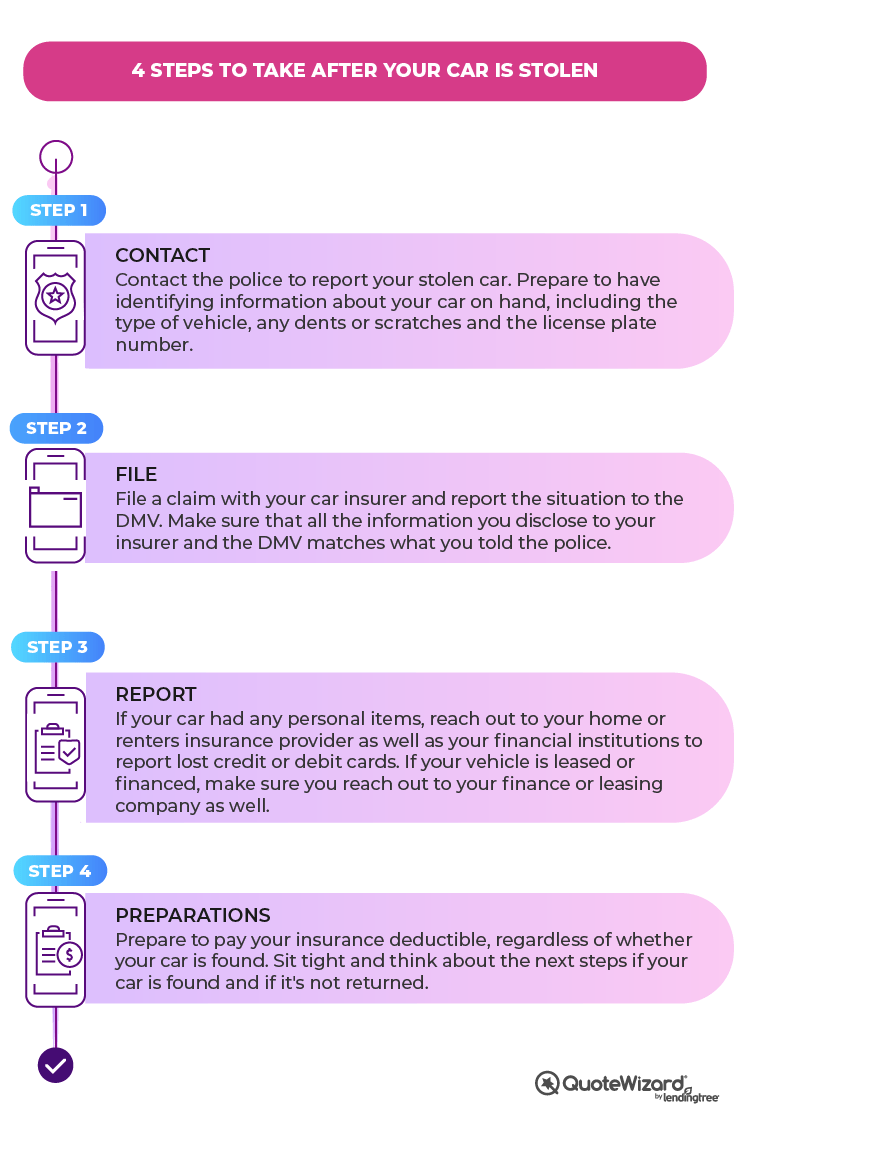

Comprehensive will pay out up to the actual cash money worth of your automobile, minus your insurance deductible if your cars and truck is swiped. Just how does space insurance work? Let's look at an example of just how void coverage refunds work to shield you when you owe money on your automobile and it's stolen or amounted to (auto).

The smart Trick of What Happens If The At-fault Party Doesn't Have Car Insurance? That Nobody is Discussing

Lease/loan insurance coverage typically has limitations on exactly how much it will certainly payment, such as 25% over the determined ACV of your vehicle. Both are minus your deductible. Example 1Say you have a $500 crash insurance deductible and also overall your lorry that is valued at $18,500 but still owe $25,000 on it. The difference between what you owe and what the worth of is $6,500.

Within mins of driving off the lot, a new cars and truck can be worth 10% much less than what you just paid (car insurance). In our instance over, if you owned the automobile for 3 days, as well as the automobile was amounted to, you can owe 10% to 20% of the $24,000 ($2,400 to $4,800 out of your pocket) although you purchased complete coverage.

If I got my automobile outright, do I need gap insurance policy? There's no reason to get this insurance coverage if you purchased a car with cash money as well as possess it without a funding (insured car). It is for when you owe more than the value of your automobile. If you have the car repaid and also it's no longer funded, you don't owe anymore even more than the cars and truck deserves, and so there would certainly be no payment from void coverage.

Void car insurance policy is just required if you have adverse equity in your auto (owe greater than the value of the vehicle) considering that this protection only pays for the equilibrium of the lending left after the ACV is paid when your auto has actually been located to be a complete loss by an insurance company - insurance affordable.

Space insurance protection is optional protection; nevertheless, it's not unusual for lease contracts to have gap insurance coverage included in them. insured car. Occasionally it's described as car loan/lease coverage or loan/lease reward protection. If a lending institution of rented automobiles requires space insurance coverage, they should include it within the lease's cost itself.

What Does Automobile Insurance Information Guide Mean?

There are some banks that may want you to have gap insurance coverage as part of your auto insurance coverage on the cars and truck you're buying - cheapest auto insurance. If this is the instance, your financing or lease documents should note this. auto. If you have actually declined gap insurance policy, a dealership shouldn't have the ability to include it on to your car loan amount or fee you for it in one more means.

The California Cars and truck Customer's Expense of Rights needs disclosure of the cost of products generally packed right into finances, such as theft etching on windows and also various other car components, gap insurance policy or extended service contracts. Generally, dealers anywhere must supply cars and truck buyers with an itemized rate listing for all these items, such as service warranties as well as insurance policy, if the things are being financed.

Unless you signed documents mentioning that you would include void insurance coverage to the car at the time of purchase as component of your finance or acquisition agreement you need to have the ability to decline it and obtain a refund. If you don't desire gap coverage and have issues getting it got rid of, attempt calling your state firm's customer division.

money auto cheaper vehicle

money auto cheaper vehicle

Gap insurance coverage might be worth it if you owe a great deal more than what the auto's worth. For instance, if you acquired an $80,000 cars and truck as well as just put down $5,000, you might desire to obtain gap insurance so you're not stuck having to make up the difference if an insurance company completes your auto.

If you are late on a car repayment of $400, that amount would certainly be deducted from your space insurance coverage pay out. When gap insurance policy does not pay? There are circumstances when space protection won't pay out. If the claim for the amounted to or swiped cars and truck is refuted for some factor, or if your car insurance policy protection lapsed, your gap insurance policy won't come into play.

How Deductibles, Coinsurance, Copays & Premiums Work Can Be Fun For Anyone

insurers auto automobile laws

insurers auto automobile laws

Your bodily injury obligation would spend for clinical costs for those you harm in a crash you cause. Your very own injuries would be covered by the other chauffeur's liability insurance or your personal injury security or Med, Pay insurance coverage. Damages you do to another auto or a person else's property would not be covered by gap insurance-- your property damage obligation would.

State legislations and insurance provider' standards vary, however there are space policies that are offered for previously owned cars that are financed. It's helpful when the value of a vehicle, whether new or used, drops while you still owe money on the lending or lease. Is space insurance policy appropriate as evidence of insurance coverage? A void policy isn't approved by any type of Department of Motor Cars as evidence of insurance coverage.

car insurance cheaper laws cheapest car

car insurance cheaper laws cheapest car

Showing proof of gap insurance coverage to law enforcement wouldn't help if they ask you for proof of insurance. It is optional insurance coverage that only assists you out in a failure circumstance, it doesn't offer the state-mandated liability insurance coverage that cops wish to verify that you have on your vehicle - credit score.

It doesn't collaborate with home loan, credit limit, balloon payments or various other kinds of non-vehicle particular loans - car insurance. If you have utilized cash from your House Equity Line of Credit Rating (HELOC) to acquire your automobile, gap insurance coverage would certainly not cover this kind of car loan considering that the HELOC is not particularly to be used for a vehicle loan.